Have you ever wondered how much construction workers earn in different parts of Pennsylvania? While wages can vary significantly based on experience, skill set, and specific project demands, there’s a crucial baseline that influences those salaries – the prevailing wage rate.

Image: fred.stlouisfed.org

In Pennsylvania, the prevailing wage rate is a minimum hourly wage that applies to certain construction projects funded by the state or federal government. It is designed to ensure fairness and protect workers from being underpaid, especially on projects that utilize public funds. This guide dives deep into the intricacies of Pennsylvania’s prevailing wage rates, exploring how they are determined, their impact on different industries, and how you can find the specific rates for your county.

Understanding Pennsylvania’s Prevailing Wage Laws

A Brief History

The foundation for prevailing wage laws in Pennsylvania dates back to the early 20th century. The Davis-Bacon Act of 1931, a federal law, established the requirement for prevailing wage rates on public works projects funded by the federal government. This landmark act aimed to prevent wage competition among contractors and ensure fair labor practices. Subsequently, Pennsylvania adopted its own prevailing wage laws, mirroring the federal provisions.

The Purpose of Prevailing Wage Rates

Pennsylvania’s prevailing wage laws serve several crucial objectives:

- Leveling the Playing Field: The prevailing wage rate ensures that all contractors working on public projects have to pay their employees a competitive wage, preventing unfair competition.

- Protecting Workers: By setting minimum wages, these laws help to safeguard workers from being underpaid and exploited, especially on large-scale projects.

- Ensuring Fair Taxation: Prevailing wage laws contribute to ensuring that public funds are utilized in a way that benefits both workers and the local economy, as fair wages stimulate spending and boost overall prosperity.

Image: www.alliancemeds.com

How Prevailing Wage Rates are Determined

The determination of prevailing wage rates in Pennsylvania follows a systematic process. The Department of Labor and Industry (DLI) is responsible for establishing these rates, taking several factors into consideration, including:

- Collective Bargaining Agreements: Prevailing wage rates are often based on wages established in collective bargaining agreements between unions and employers in specific industries.

- Wage Surveys: The DLI conducts periodic surveys to gather data on wages paid to construction workers in various parts of Pennsylvania. This information is used to establish the prevailing wage rate for different trades and occupations.

- Other Relevant Factors: The DLI also considers factors like experience level, geographic location, and the type of work being performed when setting prevailing wage rates.

A County-by-County Look at Prevailing Wage Rates in Pennsylvania

Pennsylvania is divided into 67 counties, each with its unique economic landscape and workforce composition. Prevailing wage rates can vary considerably from county to county due to factors like cost of living, local labor market conditions, and the types of projects being undertaken.

To access a comprehensive list of prevailing wage rates for each Pennsylvania county, you can visit the official website of the Pennsylvania Department of Labor and Industry. Their database allows you to search for specific rates based on county, trade, and project type.

Example: Prevailing Wage Rates in Philadelphia County

Let’s take Philadelphia County as an example. The prevailing wage rates for specific trade categories in Philadelphia can be considerably higher than those in rural counties. This disparity reflects the higher cost of living in urban areas and the demand for skilled labor in a major metropolitan city. For instance, the prevailing wage for a journey-level electrician in Philadelphia County may be significantly higher than the rate for a similar electrician in a rural county.

The Impact of Prevailing Wage Rates on the Construction Industry

Prevailing wage laws have a direct impact on the construction industry in Pennsylvania. By raising the minimum wages for workers on public projects, these laws can influence the overall cost of construction, impacting both contractors and project budgets. However, the impact can be multifaceted:

- Increased Construction Costs: Higher wages can lead to increased labor costs for contractors, ultimately affecting the overall project budget.

- Attracting and Retaining Skilled Workers: Fair wages can help attract and retain skilled workers, enhancing the quality of the workforce and contributing to better project outcomes.

- Economic Benefits: Prevailing wage laws can contribute to the overall economic well-being of communities by ensuring that construction workers have livable wages, which stimulates spending and supports local businesses.

Navigating Prevailing Wage Laws: Tips for Contractors and Workers

Understanding prevailing wage laws is essential for both contractors and workers involved in public construction projects in Pennsylvania. Here are some key tips to ensure compliance:

For Contractors:

- Consult the DLI Website: Stay informed about current prevailing wage rates for the specific county and project type you are working on. Regularly check the DLI website for updates and changes.

- Use the Correct Wage Rates: Carefully calculate and pay the correct prevailing wage rates to all eligible employees on your project, ensuring accurate record-keeping and documentation.

- Seek Guidance: If you have doubts about applying prevailing wage laws, contact the DLI for assistance and clarifications.

For Workers:

- Know Your Rights: Become familiar with the prevailing wage laws that apply to your job. You have the right to be paid the minimum rates mandated by these laws.

- Report Violations: If you believe that you are not being paid the correct prevailing wage rate, contact the DLI to report any violations.

- Seek Legal Counsel: If you face difficulties with wage issues, seek legal advice from qualified professionals who specialize in labor law.

Emerging Trends in Pennsylvania’s Prevailing Wage Laws

The landscape of prevailing wage laws is continually evolving. Recent trends and proposed changes are worth noting:

- Digitalization of Records: The DLI is moving towards online platforms for managing prevailing wage records, making it easier for contractors to access information and submit reports electronically.

- Increased Enforcement: The DLI is intensifying its efforts to enforce prevailing wage laws, conducting regular audits to ensure compliance and holding violators accountable. This increased scrutiny aims to protect workers and safeguard public funds.

- Addressing Wage Theft: The fight against wage theft is gaining momentum nationwide, with a focus on ensuring that workers receive their rightful wages. This includes addressing issues related to misclassifications and underpayment of workers.

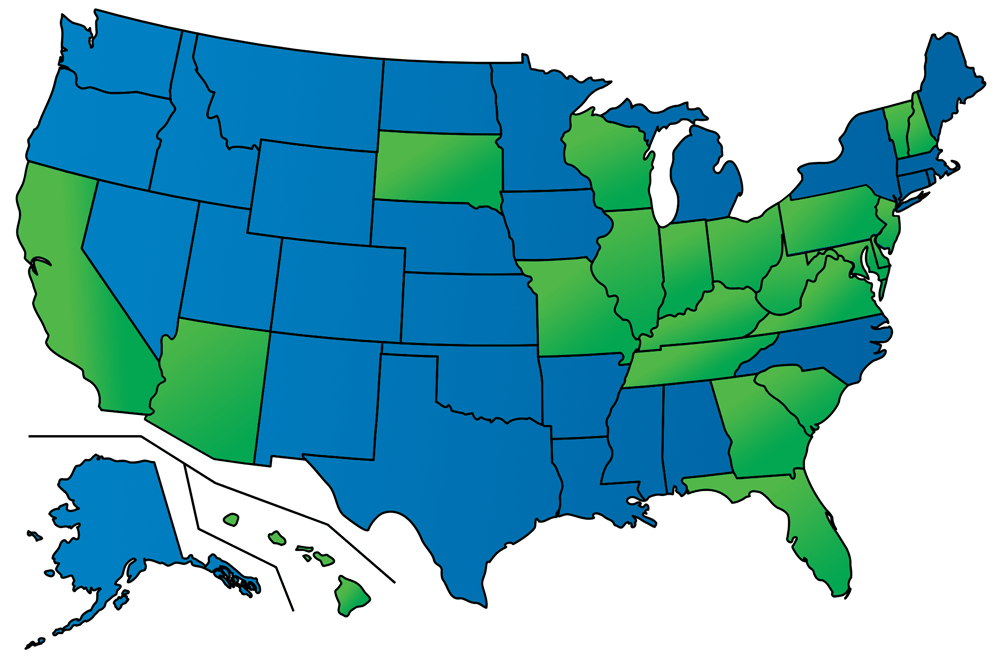

Pa Prevailing Wage Rates By County

Conclusion

Understanding the intricate world of Pennsylvania’s prevailing wage rates is crucial for anyone involved in the construction industry or working on public projects. These laws, designed to protect workers and ensure fairness, have a direct impact on wages, construction costs, and the overall well-being of the state’s economy. By staying informed about current rates, adhering to legal requirements, and advocating for fair treatment, we can contribute to a construction landscape that fosters a skilled workforce, ethical practices, and responsible use of public funds.