Imagine yourself in a time machine, traveling back to your 18th birthday. You’re handed a crisp $100 bill and given the option: spend it right now or lock it away for the next 10 years. Which would you choose? Most of us would probably say, “Spend it now!” But what if you learned that that $100, invested wisely, could turn into $200 or even $300 by the time you turned 28? The magic of compounding interest is what makes the time value of money so powerful, and understanding it can be the key to shaping a brighter financial future.

Image: www.pdfprof.com

This article will delve into the concept of the time value of money, exploring it through practical problems that will help you grasp the importance of this financial principle. We’ll explore different scenarios, from simple investments to complex loan calculations, so you can truly grasp how time and interest can work together to build wealth. By the end, you’ll be equipped to make informed financial decisions, whether it’s saving for retirement, managing debt, or simply understanding how your money grows over time.

Understanding Time Value of Money

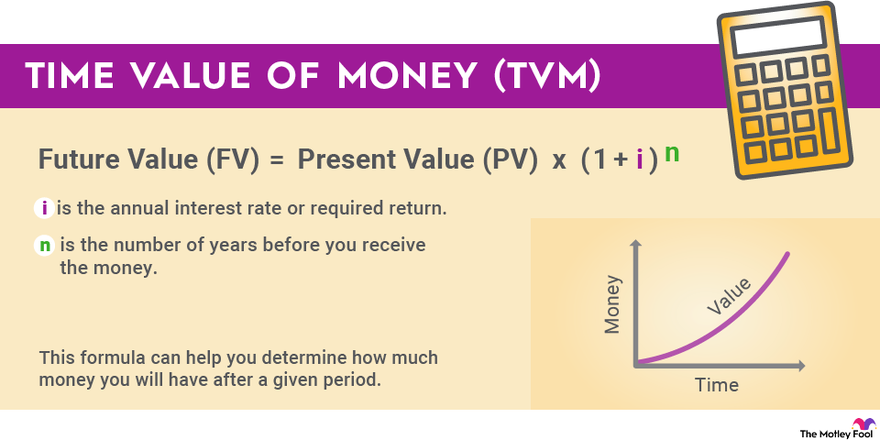

The time value of money (TVM) is a fundamental concept in finance that posits that money available at the present time is worth more than the same amount of money in the future. This is due to the potential earning capacity of the current money. In a nutshell, a dollar today is worth more than a dollar tomorrow because it can be invested and earn interest, making it grow in value.

Factors Affecting Time Value of Money

There are several factors that influence the time value of money, including:

- Interest Rates: The interest rate is the rate at which your money grows over time. Higher interest rates translate to faster growth.

- Investment Period: The longer you invest your money, the more time it has to grow.

- Inflation: Inflation is the rate at which the purchasing power of money decreases over time. It erodes the value of your money, so you need to earn a return that at least keeps pace with inflation to maintain your purchasing power.

- Risk: Higher risk investments often have the potential for higher returns, but they also carry the risk of losing money.

Time Value of Money Practice Problems

Now let’s dive into some practical examples to see how the time value of money works in real-world scenarios.

Image: www.fool.com

1. Simple Interest

Problem: You invest $5,000 at a simple annual interest rate of 3% for 5 years. How much interest will you have earned?

Solution:

- Simple interest is calculated as: Interest = Principal x Rate x Time

- Interest = $5,000 x 0.03 x 5 = $750

Answer: You will have earned $750 in interest after 5 years.

2. Compound Interest

Problem: You invest $2,000 at a compound annual interest rate of 5% for 10 years. How much will your investment be worth after 10 years?

Solution:

- Compound interest is calculated iteratively. Each year, interest is earned on the principal amount plus any accumulated interest.

- You can use the following formula: Future Value = Principal x (1 + Rate)^Time

- Future Value = $2,000 x (1 + 0.05)^10 = $3,257.79 (rounded)

Answer: Your investment will be worth approximately $3,257.79 after 10 years.

3. Present Value

Problem: You need $10,000 in 5 years for a down payment on a house. If you can earn an average annual return of 4%, how much do you need to invest today?

Solution:

- This problem involves calculating the present value (PV) of a future sum. We use the formula: PV = Future Value / (1 + Rate)^Time

- PV = $10,000 / (1 + 0.04)^5 = $8,219.27 (rounded)

Answer: You need to invest approximately $8,219.27 today to have $10,000 in 5 years.

4. Future Value of an Annuity

Problem: You plan to save $500 per month for the next 30 years. Assuming an average annual return of 7%, how much will you have saved by the end of 30 years?

Solution:

- This involves calculating the future value of an annuity, where you make a series of equal payments over time.

- There are financial calculators and online tools you can use. You can also use the formula: FV = PMT x [((1 + r)^n) – 1] / r

- FV = $500 x [((1 + 0.07/12)^(30*12)) – 1] / (0.07/12) = $715,475 (rounded)

Answer: You will have saved approximately $715,475 after 30 years.

5. Present Value of an Annuity

Problem: You want to buy a car and can afford monthly payments of $350 for the next 5 years. If the interest rate on the loan is 6%, what’s the maximum amount you can borrow?

Solution:

- This involves calculating the present value of an annuity, where you make a series of equal payments over time.

- You can use a financial calculator or the following formula: PV = PMT x [1 – (1 + r)^-n] / r

- PV = $350 x [1 – (1 + 0.06/12)^-(5*12)] / (0.06/12) = $18,624.23 (rounded)

Answer: The maximum amount you can borrow is approximately $18,624.23.

Expert Insights and Actionable Tips

These examples highlight how the time value of money plays a crucial role in various financial decisions. Financial experts emphasize the importance of starting early with saving and investing. The sooner you begin, the more time your money has to work for you, and the more powerful the effects of compounding can be.

Take advantage of tools and resources such as financial calculators, online spreadsheets, or even financial advisors to help you understand the time value of money. These tools can make it easier to model different scenarios and see how your financial decisions will impact your future.

Time Value Of Money Practice Problems

https://youtube.com/watch?v=U2aLh_IRiYo

Conclusion

Understanding the time value of money is an essential skill for anyone who wants to manage their finances effectively. By familiarizing yourself with this concept and applying it to real-world situations, you can make smart decisions that put your money to work for you.

Remember, time is money: take control of your financial future, and start making the most of your money today! For additional resources and further exploration, visit reputable websites such as Investopedia or Khan Academy. Share your own financial success stories and experiences to help others understand the power of time value of money.