Have you ever wondered how your money moves from your bank account to a merchant’s account when you buy something online? Or how a paycheck deposited into your account magically appears in your bank balance? The answer is a complex yet efficient system powered by various players, one of whom is the Chicago Federal Reserve Bank, often referred to as the “Seventh District Fed.” At the heart of this network is a unique code, the Chicago Federal Reserve Bank routing number, crucial for smooth financial transactions within the United States.

Image: www.supermoney.com

This article delves into the purpose and significance of the Chicago Federal Reserve Bank routing number. We’ll explore its place in the banking world, shedding light on its structure, how it functions, and why it is critical for individuals and businesses alike. So, let’s unravel the mystery behind this seemingly simple number and understand how it plays a vital role in the intricate fabric of the American financial system.

What is the Chicago Federal Reserve Bank Routing Number?

The Chicago Federal Reserve Bank routing number, also known as the Federal Reserve Bank Identification Number (FRB ID), is a nine-digit number that uniquely identifies the Chicago Federal Reserve Bank, one of the 12 regional Reserve Banks. This number is essential for enabling electronic fund transfers (EFTs), ensuring that funds are routed efficiently and securely to the correct destination.

The Significance of the Chicago Federal Reserve Bank Routing Number

Imagine a complex web of interconnected banks across the vast American landscape. The Chicago Federal Reserve Bank acts as a central clearinghouse within this system, facilitating the transfer of funds between banks. The Chicago Federal Reserve Bank routing number is the key that unlocks the mechanism of this system, ensuring that every transaction finds its intended recipient.

The routing number’s importance is multifaceted. Here’s why it’s crucial:

- Accurate Fund Routing: The Chicago Federal Reserve Bank routing number ensures that your money reaches the intended recipient’s bank, not someone else’s. This accuracy is vital for both individuals and businesses, preventing financial errors and ensuring smooth operations.

- Security and Reliability: The Chicago Federal Reserve Bank routing number plays a critical role in protecting your financial data. It prevents unauthorized access to your account and helps maintain the integrity of the financial system.

- Efficiency in Transactions: This routing number streamlines financial transactions by automating the communication between banks and the Chicago Federal Reserve Bank. This ensures swift processing of payments, saving businesses and individuals time and resources.

Chicago Federal Reserve Bank Routing Number: A Closer Look

The Chicago Federal Reserve Bank routing number, 071000010, is not used for all transactions. It’s specifically used when the recipient’s bank is located in the Seventh Federal Reserve District – which includes the states of Illinois, Indiana, Iowa, Michigan, and Wisconsin. The routing number ensures that the Chicago Federal Reserve Bank processes the transactions efficiently and accurately.

:max_bytes(150000):strip_icc()/Clipboard01-63561e98fbff4da683e01112d1ce865e.jpg)

Image: www.investopedia.com

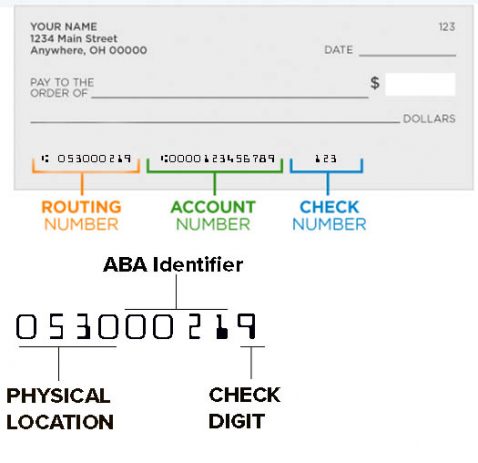

Understanding the Structure of a Routing Number

All routing numbers share a consistent structure: a nine-digit number that can be broken down into three components:

- First Four Digits: Identify the specific Federal Reserve Bank.

- Fifth Digit: Represents the check processing region within the Federal Reserve District.

- Last Four Digits: Identify the specific bank or financial institution, providing the precise destination for the funds.

Using the Chicago Federal Reserve Bank Routing Number

The Chicago Federal Reserve Bank routing number is commonly used for various transactions, including:

- EFTs: Electronic Fund Transfers, such as online payments, direct deposits, and wire transfers.

- ACH Transfers: Automated Clearing House Transfers, used for recurring payments like bill payments, payroll, and government benefits.

- Checks: The routing number is printed at the bottom of your check, ensuring that the check gets processed through the correct Federal Reserve Bank.

How is the Chicago Federal Reserve Bank Routing Number Used in Real-World Applications?

Let’s visualize the process with a concrete example. Imagine you make an online purchase from a Chicago-based retailer. When you provide your credit card information, the retailer’s bank initiates a payment instruction through an EFT network involving the Chicago Federal Reserve Bank. The retailer’s bank includes the Chicago Federal Reserve Bank routing number (071000010) in the payment instruction, ensuring that the Chicago Federal Reserve Bank processes the transaction smoothly, and your payment reaches the retailer’s account promptly.

The Future of Routing Numbers: Emerging Trends

While routing numbers remain fundamental to the banking system, technology is constantly evolving. New payment methods like mobile payments and blockchain technologies are gaining momentum. These advancements present both opportunities and challenges for the traditional banking system. How routing numbers adapt to these trends will be an exciting development to watch.

Chicago Federal Reserve Bank Routing Number

Conclusion

The Chicago Federal Reserve Bank routing number, 071000010, is an integral component of the US financial system. It guarantees accurate and secure transactions for individuals and businesses. By understanding the function and significance of routing numbers, we gain a deeper appreciation for the complex network that underpins modern finance. As the financial landscape continues to evolve, routing numbers will likely continue to play a crucial role in shaping the future of banking and payments.