The CFA Level 2 exam looms large on your horizon. You’ve poured hours into studying, mastering concepts, and wrestling with complex financial models. Now, the final weeks before the exam are here, and a new wave of anxiety washes over you: the infamous CFA Level 2 formula sheet. This seemingly cryptic document, filled with symbols and equations, can feel like a foreign language. But fret not, dear candidate, for this guide will demystify the CFA Level 2 formula sheet, turning it into your secret weapon for success.

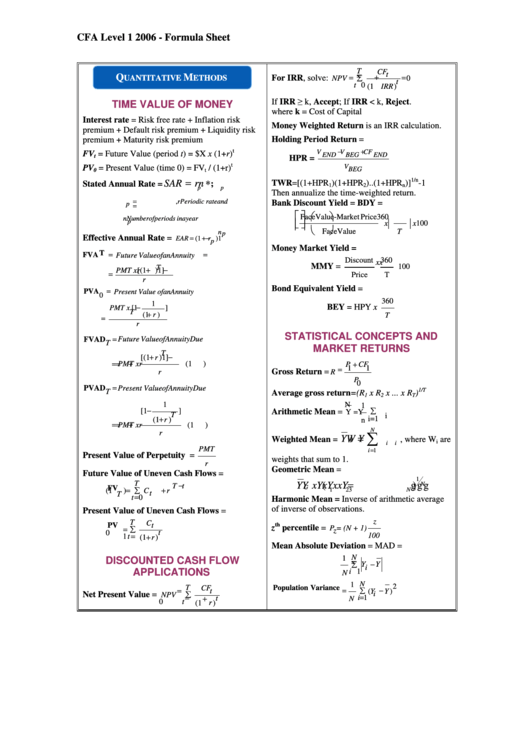

Image: finance.uworld.com

Picture this: you’re face-to-face with a grueling question, the clock ticking, your mind racing. Suddenly, a specific formula flashes in your memory, plucked from the depths of the formula sheet. With this knowledge, you confidently solve the problem, knowing that you’ve navigated the challenge with clarity and precision. This, dear candidate, is the power of mastering the formula sheet.

Deciphering the Formula Sheet: Your Guide to Success

First, understand that the CFA Level 2 formula sheet is not a substitute for understanding the underlying concepts. It serves as a powerful tool for recall, enabling you to apply those concepts during the exam. Therefore, treat the formula sheet as an aid, not a crutch.

Key Sections and Their Importance

The formula sheet is organized into specific sections, covering crucial areas of the CFA curriculum:

1. Portfolio Management: This section covers topics like asset allocation, performance measurement, and risk management. Formulas here help you calculate portfolio returns, volatility, and risk-adjusted returns.

2. Fixed Income: You’ll find formulas for calculating bond yields, durations, and convexity. These concepts are vital for understanding the relationship between interest rates and bond prices.

3. Equity Investments: Formulas related to dividend discount models, valuation multiples, and risk analysis are essential for assessing the value of a company and its stock.

4. Derivatives: This section focuses on valuation techniques and pricing models for derivatives such as futures, options, and swaps.

Making the Formula Sheet Your Own

Think of the formula sheet as your own personal cheat sheet, but a cheat sheet that requires effort to master:

1. Active Learning: Go beyond passively reading the formulas. Rewrite them, explain their components out loud, and apply them to practice problems. This active engagement will deepen your understanding and make them stick in your memory.

2. Mnemonics and Visual Aids: Creating your own mnemonics or visual diagrams for complex formulas can be a powerful memory tool. For example, imagine a “castle wall” representing the dividend discount model with each section representing a key component.

3. Targeted Practice: Don’t just memorize formulas in isolation. The CFA Institute provides practice exams that allow you to apply formulas to real-life scenarios. This will help you understand their application in a realistic context.

Image: www.sanctuaryvf.org

Beyond the Formulas: The Critical Mindset

Remember, formulas are just tools. Understanding the underlying concepts ensures you can adapt to new scenarios and solve problems that might not be directly addressed on the formula sheet. Consider these strategies:

1. Focus on the Big Picture: The CFA curriculum emphasizes analytical and problem-solving skills. Don’t get caught up in memorizing every formula; instead, grasp the logic behind them.

2. Practice, Practice, Practice: The best way to master the formulas is through consistent practice. Solve as many practice questions as possible, simulating exam conditions. This will help you identify areas where you need more practice or clarification.

3. Strategic Review: Don’t wait until the last minute to review the formula sheet. Start early and focus on specific sections depending on your individual strengths and weaknesses. This allows you to build a solid foundation and address any gaps in your understanding.

Expert Insights: Straight from the Trenches

“Don’t just blindly memorize formulas. Understand the underlying logic behind each equation. Think about the real-world situations where you would apply these concepts. This will make the formulas more meaningful and easier to recall in an exam setting,” explains a CFA charterholder and seasoned tutor.

“The formula sheet becomes a valuable tool when you’ve combined it with a deep understanding of the concepts. Practice with real examples, and you’ll be able to confidently navigate the toughest exam questions,” says another CFA charterholder.

Cfa Level 2 Formula Sheet 2023

Your Path to Success: Final Thoughts

The CFA Level 2 formula sheet is a powerful tool for success. It’s a roadmap to guide you through the technical complexities of the exam. But remember, it’s not a magic bullet. Effective use of the formula sheet requires you to engage actively with the content, practice consistently, and cultivate a deep understanding of the underlying financial concepts. Remember this as you approach the exam – your mastery of the formula sheet is not just about passing; it’s about becoming a more confident and capable financial professional.

Good luck on your journey!