Have you ever wondered how companies track their financial well-being? It’s not just about counting the cash in the drawer. Businesses use sophisticated accounting methods to understand their assets and liabilities, crucial components of their financial health. Among those, current assets and current liabilities are fundamental concepts. These categories paint a picture of a company’s short-term financial position, revealing insights into its ability to meet immediate obligations.

Image: hirewriting26.pythonanywhere.com

Imagine running a small bakery. You have a thriving business, but unexpected events happen, like a sudden increase in demand for your best-selling bread. You need to buy more flour, sugar, and other ingredients to keep up. To understand if you’re financially ready for this surge, you need to analyze your current assets and current liabilities. This analysis tells you whether you have enough liquid assets, like cash, on hand or in the near future to cover your short-term debts, like rent or utility bills. Let’s dive deeper into the world of current assets and current liabilities to unlock the secrets of a company’s financial health.

What are Current Assets and Current Liabilities?

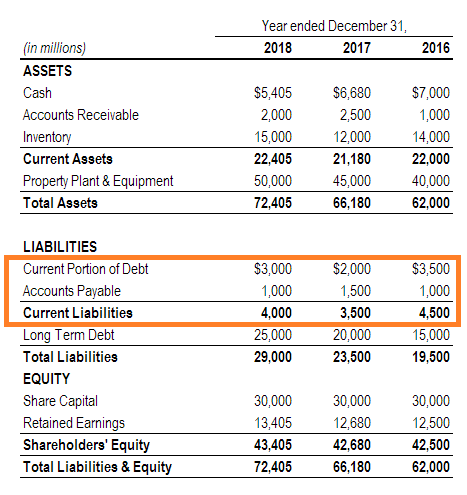

Current assets refer to all assets that a company expects to convert into cash within a year. These assets play a crucial role in daily operations and help a company generate revenue. Think of them as the company’s short-term financial resources. Current liabilities, on the other hand, represent all obligations that the company expects to pay off within a year. These are debts that need immediate attention. Understanding these concepts helps you gauge a company’s ability to meet its financial obligations and maintain its short-term financial stability.

Examples of Current Assets:

- Cash: This is the most liquid asset, readily available for immediate use.

- Accounts Receivable: Money owed by customers for goods or services already delivered.

- Inventory: Raw materials, work-in-progress, and finished goods that a company has in stock.

- Prepaid Expenses: Payments made in advance for expenses like rent, insurance, or advertising.

- Short-term Investments: Investments made with the intention of being sold within a year.

Examples of Current Liabilities:

- Accounts Payable: Money owed by the company to suppliers for goods or services received.

- Short-term Notes Payable: Loans that are due within a year.

- Salaries Payable: Wages owed to employees for work completed.

- Unearned Revenue: Payments received for goods or services that will be delivered in the future.

- Taxes Payable: Taxes that are due within a year.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Image: www.investopedia.com

Importance of Current Assets and Current Liabilities

Understanding the interplay between current assets and current liabilities is crucial for any company, large or small. Here’s why:

1. Liquidity:

Current assets are the company’s immediate resources for covering short-term obligations. A sufficient amount of well-managed current assets ensures a company’s ability to meet its debts as they come due, avoiding potential financial distress.

2. Working Capital Management:

The difference between current assets and current liabilities is known as working capital. It reflects a company’s ability to manage its day-to-day operations effectively. Positive working capital indicates a healthy financial position, while negative working capital can signal potential difficulties, as the company may not have enough resources to cover its short-term obligations.

3. Financial Health:

Analyzing the ratios of current assets and liabilities can reveal a lot about a company’s overall financial health. For example, the current ratio (current assets divided by current liabilities) provides a crucial indicator of a company’s ability to repay its short-term debts. These ratios help investors make informed decisions about investing in a particular company.

4. Investment Decisions:

Investors look at the relationship between current assets and liabilities as a critical indicator of a company’s financial health. A strong current asset position and a manageable level of current liabilities signal a company that can manage its short-term obligations responsibly and potentially generate good returns for investors.

Tips and Expert Advice for Effectively Managing Current Assets and Liabilities:

Managing current assets and liabilities effectively is an essential aspect of financial success. Here are some expert recommendations:

1. Optimize Inventory Levels:

Maintaining adequate inventory is crucial for smooth operations, but excessive inventory ties up resources and can lead to storage costs and obsolescence. Implement inventory management systems to track stock levels, minimize waste, and optimize inventory turnover.

2. Streamline Accounts Receivable:

Efficiently managing accounts receivable ensures timely payments from customers. Adopt effective credit policies, offer incentives for early payments, and consider using collection agencies when necessary to minimize bad debts.

3. Negotiate Favorable Payment Terms:

Negotiate payment terms with suppliers that allow for a reasonable timeframe before payments are due. This will give your business more flexibility and improve cash flow management.

4. Monitor Cash Flow:

Closely track your cash inflows and outflows to stay on top of your financial situation. This will help you identify potential cash flow shortages and develop strategies to address them proactively.

Common FAQs:

1. What is the difference between current assets and long-term assets?

Current assets are expected to be converted into cash within a year, while long-term assets have a lifespan longer than one year. Examples of long-term assets include buildings, equipment, and land.

2. What is the significance of the current ratio?

The current ratio is a measure of a company’s liquidity, indicating its ability to pay its short-term obligations. A current ratio of more than 1 generally indicates a healthy financial position.

3. How can I improve my working capital management?

Working capital management involves optimizing current assets and liabilities. Strategies include improving accounts receivable, managing inventory efficiently, and negotiating favorable payment terms with suppliers.

4. Why are current liabilities important?

Current liabilities represent short-term obligations a company needs to pay within a year. They are essential for understanding a company’s immediate financial obligations and its ability to manage short-term cash flow.

5. What are some signs of potential cash flow problems?

Signs of cash flow problems can include delayed payments from customers, high accounts payable balances, and a declining current ratio.

List Of Current Assets And Current Liabilities

Conclusion:

Understanding the intricacies of current assets and current liabilities is fundamental to any business’s financial well-being. By effectively managing these essential elements, companies can ensure they have the necessary resources to meet their short-term obligations, maintain their operational efficiency, and achieve long-term financial stability.

Are you interested in delving deeper into specific strategies for managing current assets and liabilities? Let us know in the comments below!