Have you ever found yourself in a situation where you needed to delegate the authority to someone else to claim something on your behalf? Perhaps you’re recovering from an injury, traveling abroad, or simply too busy to handle the process personally. This is where an authorization letter comes in handy. It’s a formal document that grants someone the power to act on your behalf, and understanding its importance can significantly ease the burden of processing claims.

Image: www.aiophotoz.com

This article delves into the world of authorization letters, specifically focusing on those used for claims. We’ll explore their purpose, how to write one effectively, and provide real-world examples to illustrate their application. By understanding these crucial elements, you’ll be equipped to navigate various claim scenarios with confidence.

What is an Authorization Letter for Claims?

An authorization letter for claims is a written document that formally grants another individual or entity the power to act on your behalf in pursuing a claim. The claim can be related to insurance, legal disputes, reimbursements, or any other situation where you need to assert your rights.

Imagine you’re in a car accident and are unable to handle the insurance paperwork. You can authorize a trusted friend or family member to communicate with the insurer and process the claim on your behalf. This letter clearly outlines the specific powers you’re granting, ensuring everyone involved is aware of your intentions.

Why Use an Authorization Letter?

Authorization letters for claims serve numerous purposes, promoting efficiency and clarity in handling sensitive matters:

- Convenience and Time-Saving: Authorization letters allow someone to handle claims while you focus on other responsibilities, saving you time and effort. Imagine needing to file a claim for a damaged item while you’re busy with work. With an authorization letter, someone else can handle it for you, reducing stress and complications.

- Legal Authorization: It provides legal proof that you’ve authorized another party to act in your best interests. This ensures that the individual or entity can legally represent you and make decisions pertaining to your claim.

- Clarity and Transparency: The letter explicitly outlines the specific powers granted, leaving no room for ambiguity. This eliminates uncertainty and promotes understanding among all parties involved.

- Safeguarding Your Interests: By providing written authorization, you ensure that your rights and interests are protected, reducing the risk of misunderstandings or unauthorized actions.

When is an Authorization Letter Needed?

Authorization letters for claims are necessary in situations where you cannot personally handle the claim process due to various reasons:

- Physical Incapacity: If you’re hospitalized or unable to handle the paperwork, an authorized representative can handle the process for you.

- Geographic Distance: When you’re traveling abroad or relocating to another city, an authorization letter allows someone to handle claims on your behalf at your current address.

- Time Constraints: If work or other commitments prevent you from personally filing a claim, an authorization letter allows someone to do it for you.

- Legal Matters: During legal proceedings, an attorney can be authorized to represent your interests and manage your claim, ensuring your rights are upheld.

Image: resume.alayneabrahams.com

Key Elements of an Authorization Letter for Claims

An effective authorization letter is concise, clear, and contains specific details to ensure its legal validity. Here are crucial elements to include:

- Your Name and Contact Information: Clearly state your full name and provide your contact details for verification.

- Recipient’s Name and Contact Information: Include the full name and contact information of the individual or entity you are authorizing.

- Claim Details: Specify the nature of the claim, including the date of incident, type of claim (e.g., insurance, legal, etc.), and any relevant reference numbers.

- Scope of Authority: Clearly outline the specific powers you are granting. State whether they can communicate with the relevant entity, file documents, receive payments, or negotiate settlements on your behalf.

- Duration of Authorization: Specify the timeframe for which the authorization is valid. It could be for a specific period or until further notice.

- Signature and Date: Sign the letter legibly and include the current date.

- Witness Signature (Optional): Having a witness sign the letter can strengthen its validity, especially in legal settings.

Sample Authorization Letter for Claims

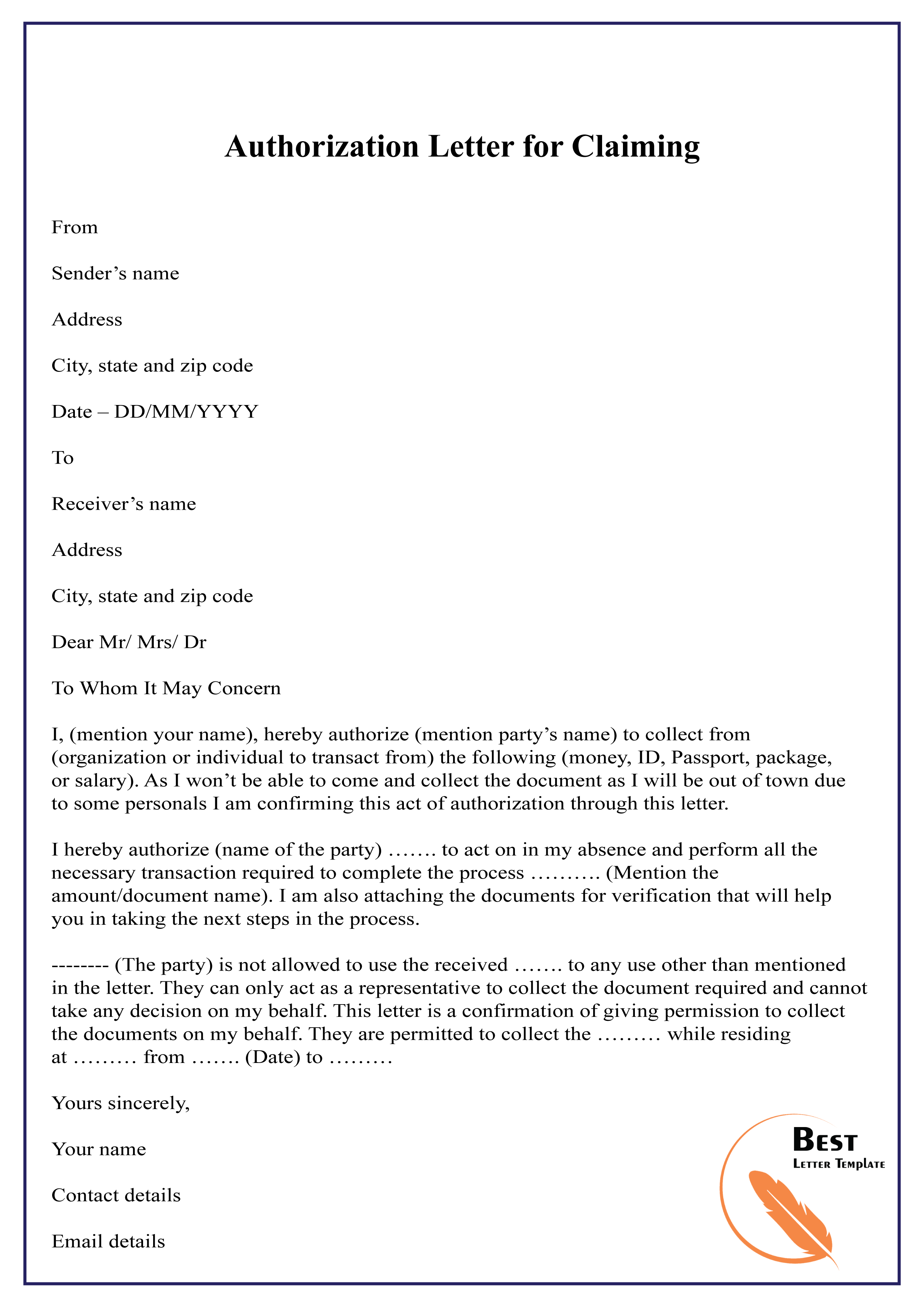

Here’s a sample authorization letter you can use as a template:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient’s Name]

[Recipient’s Address]

Subject: Authorization for Claim [Claim Number/Reference]

This letter authorizes you to act on my behalf in connection with the claim [briefly describe the nature of the claim, e.g., car accident damage, medical reimbursement, etc.].

You are hereby authorized to:

- Communicate with [Name of entity, e.g., insurance company, legal representative, etc.] regarding this claim.

- File necessary documents and paperwork related to this claim.

- Receive payments and settlements on my behalf.

- [Add any other specific powers you’re granting, e.g., negotiate settlements, authorize medical treatment, etc.]

This authorization is effective as of [Date] and will remain in effect until [Date/further notice].

Sincerely,

[Your Signature]

[Your Typed Name]

Dos and Don’ts for Writing an Authorization Letter

While the sample letter provides a good starting point, keep these key points in mind when drafting your authorization letter:

- Be Clear and Concise: Use plain language and avoid technical jargon to ensure the letter is easy to understand.

- Specify the Scope: Clearly define the powers granted to avoid any confusion.

- Use Professional Language: Maintain a formal tone throughout the letter.

- Proofread Carefully: Ensure there are no errors in grammar or spelling for a professional appearance.

- Consider Legal Advice: For complex situations, consult a legal professional to ensure the letter is legally sound and protects your rights.

Real-World Applications of Authorization Letters for Claims

Authorization letters play a crucial role in various scenarios involving claims:

- Insurance Claims: If you’re incapacitated, you can authorize a family member or friend to handle insurance claims on your behalf, including filing paperwork, communicating with the insurer, and receiving reimbursements.

- Legal Claims: In legal disputes, you often need to authorize an attorney to represent your interests, file relevant documents, and negotiate settlements.

- Reimbursement Claims: If you’re receiving a reimbursement for expenses, such as medical costs or travel expenses, you may need to authorize someone to receive the funds on your behalf.

- Tax Claims: For taxation matters, you might need to authorize a tax advisor to file claims, handle tax audits, or receive tax refunds on your behalf.

Sample Of Authorization Letter To Claim

Conclusion

An authorization letter for claims is an essential tool for empowering someone to act on your behalf, ensuring your interests are protected and claims are handled efficiently. By understanding its purpose, key elements, and real-world applications, you can effectively delegate the authority to handle claims, minimizing stress and ensuring your rights are upheld.

Remember, this is just a starting point. Each situation is unique, and you may need to tailor the letter to your specific circumstances. If you have any doubts, consult a legal professional to ensure your authorization letter is legally binding and protects your interests.